New IIT law

In June 2018 the Standing Committee of the National People’s Congress proposed major amendments to the PRC Individual Income Tax Law (IIT Law). These changes take effect in October 2018, with full implementation of the revised law planned for January 2019. Some changes include:

1) Tax deduction: The statutory deduction (i.e. the first part of the salary that is not subject to IIT) will increase to CNY 5000 (from CNY 3500 for Chinese employees, and CNY 4800 for foreigners).

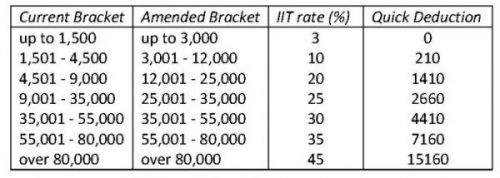

2) Tax rate: Current and Amended Tax Brackets for IIT on Monthly Taxable Income (after standard deduction and allowable deductions):

More important, is the shuffling/lowering of income tax rates for employees with taxable income of up to CNY 35,000. As an example of the scope of these changes, a Chinese resident national with a taxable income of CNY 40,000 per month would have to pay CNY 8,195 in taxes; but under the amendments his tax burden will fall to CNY 6,090, and that is without even considering the new special deductions.

3) Deductible expenses:

• Education expenses for children;

• Expenses for further self-education;

• Health care costs for serious illness;

• Housing loan interest;

• Housing rent.

4) The amended IIT Law reduces the residency qualification from 1 year to 183 days. This means that any foreign individual who has stayed in China for 183 days or longer in a calendar year will be considered a resident, with income sourced within or outside the country subject to IIT.

5) There will be annual tax settlement also for IIT. A resident tax payer needs to declare and make annual ITT settlement for income sourced within and outside China between March and June next year.